Welcome to our Property Tax Impact Calculator. This tool is designed to help homeowners in Cape Elizabeth understand how various school building projects could affect their annual property tax bills over the next several years.

How to Use the Calculator:

- Enter Your Assessed Home Value: Start by typing your property’s assessed value into the input box. This is typically the value assigned by the local municipality for the purposes of determining property taxes.

- Calculate: Click the “Calculate Tax” button to see how different projects will impact your property taxes from 2025 to 2030.

- Review Your Results: The calculator will display the total taxes due for each scenario across the specified years, along with the percentage increase or decrease compared to the baseline scenario where no new projects are undertaken.

Property Tax Comparison Calculator

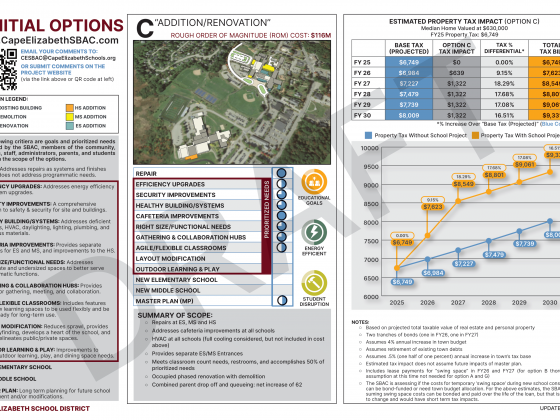

| Fiscal Year | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|

| Assessed Value | $700000 | |||||

Assumptions Built into the Calculator:

- Mill Rate Changes: The calculator assumes specific mill rates for each project over the years. A mill rate is the amount of tax payable per dollar of the assessed value of a property. Each project scenario has a different projected mill rate based on potential budgetary requirements to fund the project.

- Fixed Assessed Home Value: It is assumed that the assessed home value remains constant at the entered value throughout the forecast period. In reality, assessed values can change due to various factors such as market trends and improvements to the property.

- Project Scenarios: Each project scenario (B, C, and E) reflects a different level of investment in school facilities, which in turn affects the mill rate:

- No Project (Baseline): Assumes no changes or additional funding requirements.

- Project B: Involves moderate renovations and updates, leading to a slight increase in mill rates.

- Project C: Encompasses significant rebuilding efforts, requiring higher mill rates.

- Project E: Consists of extensive construction and facility upgrades, resulting in the highest mill rates.

- Tax Calculation Methodology: The tax for each year is calculated by multiplying the assessed home value by the mill rate (divided by 1,000) for that year under each scenario.

Important Notes:

- The results provided by this calculator are estimates based on the assumptions mentioned and should be used for general guidance only. Actual tax rates and assessed values may vary.

- Please consult with local tax assessors or a professional advisor for precise calculations and tax planning.

By understanding these parameters, you can better utilize this tool to forecast potential changes in your property taxes linked to community decisions about school infrastructure.